flow-through entity tax form

This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain and loss resulting from the disposition of shares of or interests in a flow-through entity. The income and losses are already classed and apportioned for Pennsylvania purposes as reported on the Schedule RK-1 and NRK-1.

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

GreenStones tax and accounting department has spent time evaluating the possible benefits and.

. In tax years beginning in 2021 flow-through entities with items of international tax relevance must complete the new schedules as described in the instructions and the updates posted on January. Registration for FTE tax in this manner will interrupt the filing andor payment process. As part of the electronically filed Schedule 3K-1 and SK-1 forms the pass-through entity will be asked to provide information identifying the member as an.

This guidance is expected to be published in early January 2022 and will be posted to the Departments website. However after registration is complete you will be allowed to continue. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest.

Registration for FTE tax can also be accomplished through the Fast File or Fast Pay Guest Service portals discussed later in this guide. Income From Pass Through Entities. One particular flow-through compliance concern is the existence of complex structures of related entities.

The continued levy of the tax is contingent upon the existence of the federal state and local tax SALT deduction limitation codified within IRC 164b6B. Legislation amending the New York City pass-through entity tax NYC PTET has passed both houses of the NYS Legislature. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

This legislation was passed as a workaround to the federal 10000 state and local tax deduction limitation that has frustrated many business owners since it was passed in 2017 as part of the Tax Cuts and Jobs Act. Reporting Non-electing Flow-Through Entity Income Form 5774 Schedule for Reporting Member Information for a Flow-Through Entity Do not send copies of K-1s. The flow-through entity tax annual return is required to be filed by the last day of the third month after the end of the taxpayers tax year.

Governor Whitmer signed HB. Form W-8 IMY may serve to establish foreign status for purposes of sections 1441 1442 and 1446. Flow-throughs are also a growing tax compliance concern.

5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan. It replaces line 16 portions of line 20 and numerous unformatted statements attached to prior versions of the Schedule K-1 Form 1065 Schedule K-1. 2021 Flow-Through Entity Tax Annual Return Form Warning Save functionality for FTE returns is forthcoming in the meantime enter all return data in one session.

When they do the result is a structure with multiple layers. Enter details about the business entity. A pass-through entity is an entity whose income loss deductions and credits flow through to members for Massachusetts tax purposes.

If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity the elected capital gain you reported created an exempt capital gains balance ECGB for that entity. The flow-through entity tax is retroactive to tax years beginning on and after January 1 2021. This optional flow-through entity tax acts as a workaround to the state and local taxes SALT cap which was introduced in the Tax Cuts and Jobs Act of 2017 to limit the amount of SALT allowed as a federal itemized deduction to 10000.

Many flow -through entities are allowed to allocate income to other flow-throughs. Refunds received under the flow-through entity tax or city income tax Income from the production of oil and gas Income derived from a mineral Miscellaneous subtractions. For further questions please contact the Business Taxes Division at 517-636-6925 and follow the prompts for Corporate.

Branches for United States Tax Withholding and Reporting including recent updates related forms and instructions on how to file. The online application to opt in is now available and you must make an estimated payment with the eligible entitys election. The information in this section also applies if for the 1994 tax year you filed Form.

Pass Through entities must provide to its entity owners a Schedule RK-1 and NRK-1 detailing the entity owners share of pass through income and losses during the taxable year. Flow-Through Withholding FTW registration does not constitute a valid election into FTE nor. The deadline to opt in to the New York State PTET has been extended to September 15 2022.

However the late filing of 2021 FTE returns will be accepted as timely if filed within 6 months of the due date. The following are all pass-through entities. For calendar filers that date.

Through entity receiving a payment from the entity I certify that the entity has obtained or will obtain documentation sufficient to establish each such intermediary or flow-through entity status as a participating FFI registered deemed-compliant FFI or FFI that is.

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

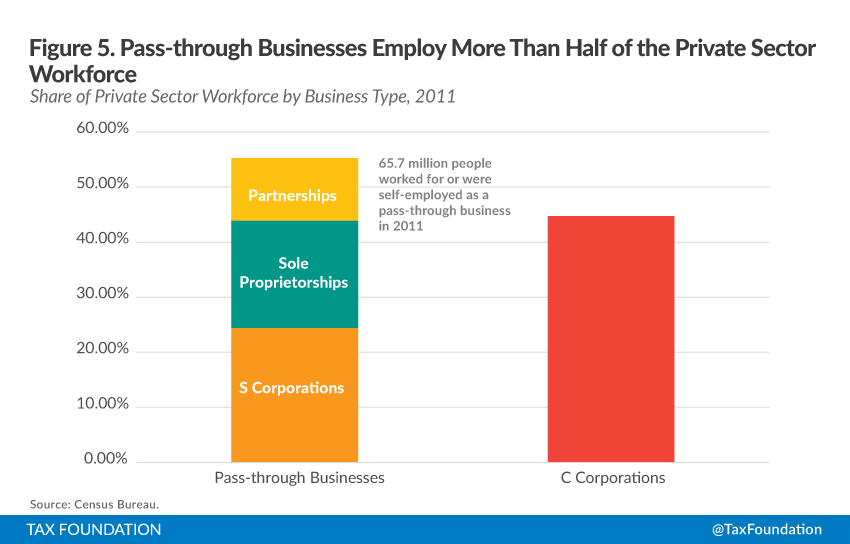

An Overview Of Pass Through Businesses In The United States Tax Foundation

Tax Guide For Pass Through Entities Mass Gov

Elective Pass Through Entity Tax Wolters Kluwer

Pass Through Entity Definition Examples Advantages Disadvantages

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Pass Through Entity Tax 101 Baker Tilly

Pass Through Entity Definition Examples Advantages Disadvantages

Understanding Your 1042 S Payroll Boston University

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

What Is Schedule C Tax Form Form 1040

Understanding The 1065 Form Scalefactor

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

An Overview Of Pass Through Businesses In The United States Tax Foundation